Causes of Shenzhen's Soaring Housing Price

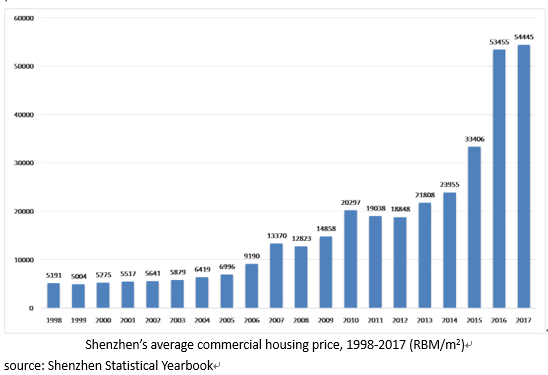

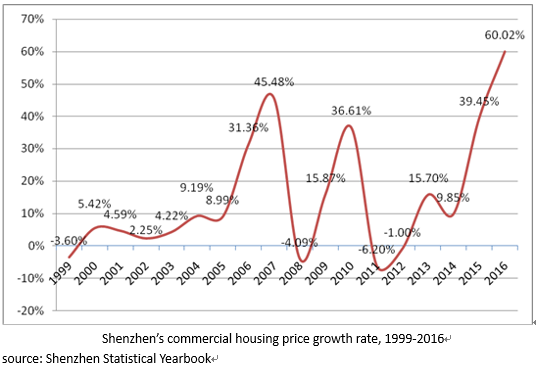

Shenzhen’s housing price started to rise in the second half of 2005, and mounted to 13,370 RMB/m2 in 2007. With the whirlwind of the financial crisis in 2008, Shenzhen’s housing price went down, but soon climbed back in 2009. With the release of 4 trillion RMB stimulus package and a shift to proactive fiscal policy and expansive monetary policy to increase investment and consumption in response to the global financial crisis, Shenzhen’s housing price made another stride to 20,297 RMB/m2 in 2010. Despite of series of macro-regulatory policies to control and lower housing price nationwide in 2010 and 2011, Shenzhen’s housing price continued to rise, though at a slower pace between 2011 and the first half of 2015. However, in 2015 and 2016, Shenzhen’s housing price skyrocketed to 55,871 RMB/m2, as policymakers in Shenzhen followed suit to ‘de-stock’ the housing market when demand far outweighed supply. Shenzhen started to take cooling measures in 2017, imposing quotas on the housing market to bring down the city’s meteoric housing price. However, government can intervene in the pricing of newly-built apartments but intervention proves much difficult in the second-hand housing market, rendering Shenzhen a spectacle where second-hand housing price is much higher than newly built ones.

Shenzhen was the first in China to usher in land-use rights auction and the commercialization of real estate but the land price and housing price remained normal. In 2004, the average price of commercial residential building was 6,000 RMB/m2. Why, then, has it boosted on such a fast pace? It is thus worth examining Shenzhen’s housing system, fiscal policy and land policy in order to have a glance of the rooted defects in the top-level design. The soaring housing market in Shenzhen results from

1 a shift from indemnificatory apartment provision to commercial housing market 2 local government’s reliance on land finance to increase government revenue and expand fiscal income

3 government’s monopoly over the land system

The rapid growth of Shenzhen’s housing market has contributed to Shenzhen’s high GDP growth and fed the local government with stable and flourishing revenue, while making houses unaffordable to ordinary people. Shenzhen’s high housing price

1 makes it impossible for ordinary people with an average income of 89760 a year in 2016 to purchase a commercial apartment, which was priced at 53,455 RMB/m2 under strict government regulation in 2016 2 also leads to increases in rents, driving the price of commodities and services to rise as well.

3 adds costs to businesses, crowding out manufacturing and logistics industries

4 dampens the aspiration of younger generation to settle down in Shenzhen

5 impairs living conditions of middle-class and low-income families

6 hijacks the banking system, increasing systematic risks in the financial sector

7 increasing household debt ratio

8 widening the gap in income inequality

9 leads to swelling unlicensed construction