Lessons from Japan's Debt Crisis

Ms. Okazaki Kumiko research director of the Canon Institute for Global Studies, Japan, joined the Public Lecture Series on November 7th, sharing Japan’s experiences with debt crisis in 1980s and current financial challenges.

The Bank for International Settlement reveals that the ratio of outstanding obligations of non-financial departments to GDP is 368.7 percent, in which government debt is 212.5 percent. Most economists believe that the debt ratio in Japan is alerting.

Against the backdrop, Kumiko looks into Japan’s debt issues in 1970s. With the halt in Japan’s rapid economic growth and increasing demand for social welfare and environmental protection, the country was facing tremendous fiscal pressure. Government debt thus skyrocketed while the private sector remained stable. However, when it comes to the 1980s, imbalances in corporate debt started to emerge. With the burst of the financial bubble, most Japanese financial institutions and corporates have adjusted their balance sheets, resulting in prolonged depression. The fall in labor force added to their woes, forcing Japanese government to increase fiscal expenses. Until now, Japan’s fiscal pressure has not been relieved or improved.

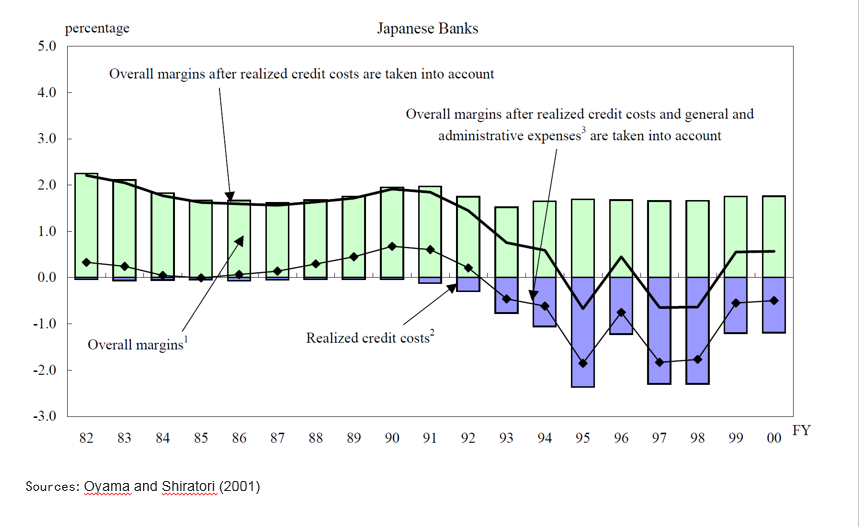

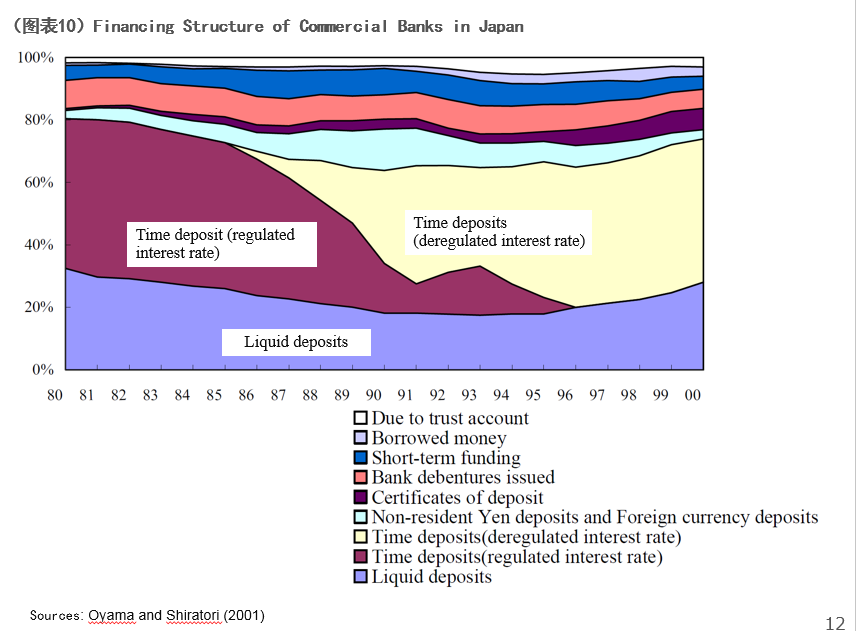

Kumiko points out that Japan’s financial crisis in the 1980s and 1990s resulted from

-increasingly vibrant and free financial activities, which led to

-slumps in banks’ return rates

-increases in capital

-dysfunctional crisis management system

-extending lax monetary policy

-policies to restrict the development of real estate industry

-loopholes in supervisory and regulation

-overconfidence in Japan’s economy